-

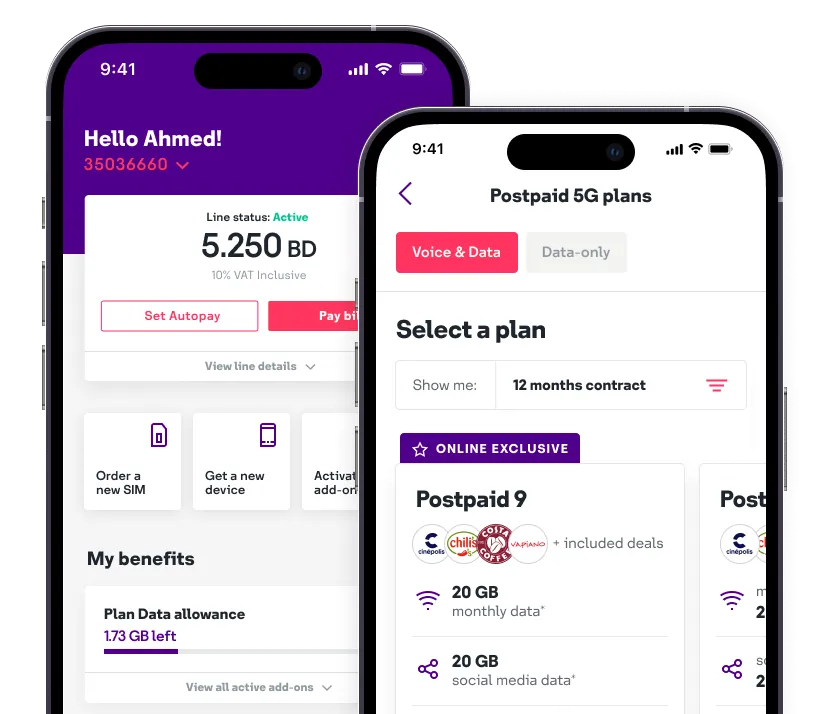

BD9.900/month

-

20 GB Unlimited Data

-

5 GB (valid for 3 months) Online Exclusive Data

-

20 GB Social Media Data

-

stc to stc calls and SMS Unlimited

-

600 Local Minutes

-

Free 5G Access

-

12 Months Contract Period

Upgrade or buy new Postpaid and Prepaid Plans,

Fiber Internet, 5G, devices, iPhone & Samsung from stc Bahrain e-shop.

-

BD13.200/month

-

35 GB Unlimited Data

-

8 GB (valid for 12 months) Online Exclusive Data

-

Unlimited Social Media Data

-

stc to stc calls and SMS Unlimited

-

1000 Local Minutes

-

Free 5G Access

-

12 Months Contract Period

-

BD17.600/month

-

50 GB Unlimited Data

-

10 GB (valid for 12 months) Online Exclusive Data

-

Unlimited Social Media Data

-

stc to stc calls and SMS Unlimited

-

1500 Local Minutes

-

Free 5G Access

-

12 Months Contract Period

Unlimited streaming and entertainment

with our 5G Home Broadband & Fiber Plans

-

BD11.000/month

-

1000 GB Monthly Data

-

50 Mbps/20 Mbps Download/ Upload Speed

-

24 months Contract Period

-

BD22.000/month

-

Unlimited Monthly Data

-

200 Mbps/50 Mbps Download/ Upload Speed

-

24 months Contract Period

-

BD5.500/month

-

1st year BD 5.500/month, 2nd year BD 16.500/month

-

900 GB Monthly Data

-

100Mbps/20Mbps Download/ Upload Speed

-

BD24.200/month

-

Unlimited Monthly Data

-

200 Mbps/100 Mbps Download/ Upload Speed

-

24 months Contract Period

Say hello to savings. Bundled up with our unique deals

We're not your average telecom company.

Check out the services that make stc even more sweet.